Section 1 Liabilities for other property

7.1.1 General

This is the general third party liability section. The extent of cover is described in broad, general terms since it is mainly dependent on the risks excluded under the Hull policy and those risks not covered elsewhere under any other P&I Rule.

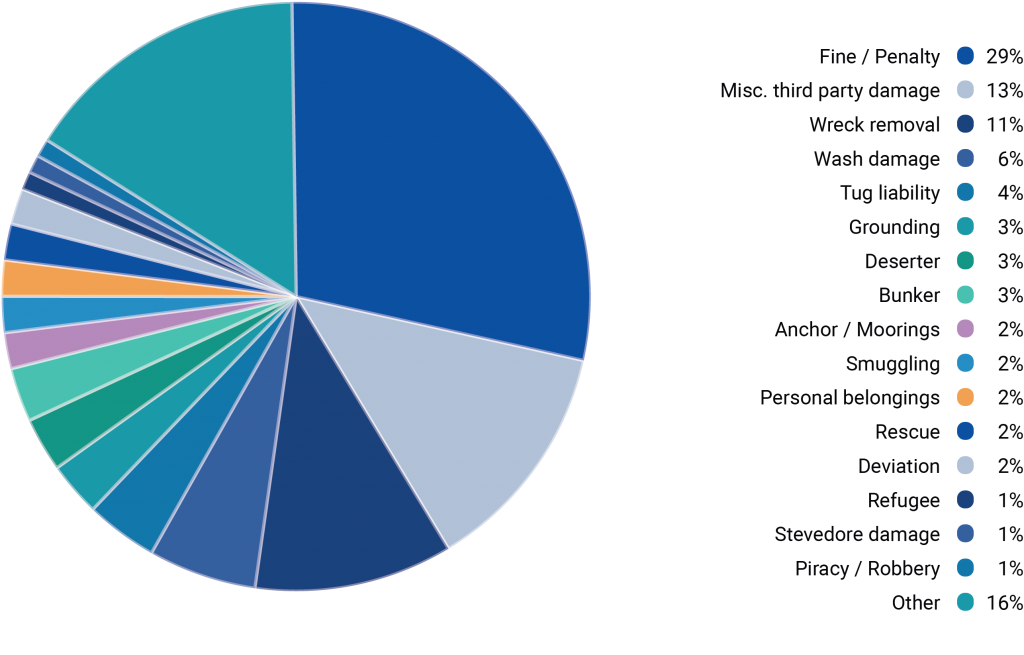

No of claims 2015-2019

7.1.2 Hull liability exclusions

This section is not exhaustive when it comes to cover for risks excluded under the Hull insurance conditions. Some of the main exclusions under Hull insurance are reflected in Rule 3 (Liabilities in respect of persons), Rule 4 (Liabilities in respect of cargo) and Rule 6 (Liabilities in respect of pollution). Further exclusions are dealt with separately in subsequent sections of Rule 7.

Depending on the Hull insurance conditions agreed, the exclusions could refer to liability for collision with objects other than ships, such as quays, piers, buoys, dolphins, etc. (FFO – Fixed and Floating Objects) or to part of the collision liability not covered under the Hull insurance conditions, e.g. 1/4 collision liability under the Running Down Clause (RDC).

This clause is geared to cover the remaining, unspecified and traditional limitations of cover for third party liability under the Hull policy.

7.1.3 Non-contact damage by manoeuvring

Without having been in direct contact with another ship, the entered ship may cause that other ship to run aground or collide with a third ship or cause damage to the quay at which it is moored. The cause of the accident can be negligent manoeuvring on the part of the entered ship or the consequence of interaction as described under 7.1.4. As there is no direct contact, the liability of the entered ship is commonly not covered under the Hull policy. Cover usually remains with the Hull insurance if the manoeuvre leading to the accident was deliberately made to avoid a collision covered under the Hull policy. For the other alternatives not covered by the Hull insurance, cover is instead provided under this clause.

For further clarification the Club should be immediately informed when indirectly caused damage of this nature has occurred.

7.1.4 Interaction or “wash damage”

7.1.4.1 General views on interaction

Another example of liability excluded under most Hull policies is what is commonly referred to as “wash damage”. Fields of pressure and suction of various strengths and intensities are built up when a ship proceeds through the water. This phenomenon is described as interaction between the fields of pressure and suction from ships or objects involved.

7.1.4.2 What is interaction?

When two or more ships are in close proximity, such interaction can occur. Pressure fields around the vessels interact with each other producing lateral forces and movements in both ships. The forces or movements can change direction rapidly depending on the relative positions of the ships. These forces do not arise from sea or weather conditions but result solely due to the presence of the ships. Shallow and confined waters magnify the effect so that a ship may deviate from her intended course with unforeseen consequences.

Pressure and suction forces are increased by the size and speed of each ship and by the depth of water. The forces increase and can change character unexpectedly when a ship passes close to a fixed surface such as a quay wall or a bank. “Bow-in” or “bow-out” forces may suddenly appear of such strength that they cannot be counteracted even by instant rudder manoeuvres. This is a serious danger when a tug moves alongside a large ship. “Bow-in” or “bow-out” forces may cause the tug to get sucked under the stern of the ship or into her propeller. A ship exposed to interaction may sheer and run aground, or collide with another ship or object. Regardless of what caused the accident, the presence or absence of a direct contact will usually determine whether the case falls under Hull or P&I policy.

7.1.4.3 Effect of interaction on moored ships

The most frequent type of damage caused by interaction is when a ship moored at a quay gains interaction momentum from a passing ship and starts to move along the pier. It often causes the moorings to break, but serious damage can also be caused to the ship, her gangway and/or to loading/discharging equipment such as conveyor belts, cranes, hoses or loading/discharging arms as well as any shore installations, such as bollards or even the entire pier with anything on it. The damages caused will be claimed against the passing ship.

The cover under this Rule would also include the Member’s legal liability in respect of economic loss resulting from covered loss/damage to property of third parties.

7.1.4.4 Burden of proof

7.1.4.4.1 General comments on liability and burden of proof

For this type of damage, the passing ship has traditional liability for negligence (in tort) with the burden of proof resting on those who suffered damage. In practice, though, courts have a tendency to assume negligence based on the damage sustained. This means that they may accept such a low standard of evidence produced by the claimant that liability becomes almost strict. (See the comments under 4.1.4.4.) In certain ports and jurisdictions, liability is indeed strict as a result of mandatory port conditions, which apply to traffic in waters where the accident occurred.

There may be many reasons why the courts try to shift the burden of proof to the passing ship. One reason is that evidence for the passing ship is mainly to be found on board that ship. It is important that such evidence is timely secured and made available to the Club. When proceeding in narrow waters where such damage is more likely to occur, the proceeding ship should regularly record the time for passing noticeable landmarks such as locks, bridges, quays, etc. This will make it possible afterwards to calculate her speed in order to establish whether it was excessive or not. The name of the attending pilot and of the people on the bridge should be noted. Strength and direction of wind, tide and current should be recorded and the voyage data recorder (VDR) should be working properly. Preferably, all observations of ships passed, their location and the number and state of their moorings should be recorded in the deck log as well as the name of ships met or overtaken be noted, including position and time. AIS data greatly reduces the burden of collecting such evidence.

In a wash damage case, the claimant has the initial burden to prove:

- That the interaction was actually caused by the ship against which the claim is made.

- That her passing was negligent.

- That the ship on behalf of which the claim is made did not contribute to the damage by negligence.

7.1.4.4.2 Causation

With regard to the first element, it is sometimes difficult for a claimant to establish a causal connection between the damage and the passing ship. The alleged time for the damage may not coincide with the time of the passing. There may have been other ships around at or about the time reported. The burden is on the claimant to exclude the possibility that those ships caused or contributed to the damage.

7.1.4.4.3 Negligence

Even if the claimant is successful in proving that the damage was caused by interaction with the passing ship, this is not enough to constitute legal liability to compensate for the damage. Large ships inevitably cause considerable interaction when proceeding in shallow water even if they are underway at the necessary steering speed. Therefore, the claimant needs to prove the second element, i.e. that the passing was negligent. An important factor in establishing negligence is whether speed regulations exist and were violated. If so, it is a strong argument against the passing ship. Also speed within the limit may still be considered excessive if the fairway was shallow and narrow and the ship could have travelled safely at a slower speed.

7.1.4.4.4 Contribution

When it comes to the third element of the claimant’s burden of proof, the location of the damaged ship, the degree of lookout and vigilance and, in particular, the number, quality, application and tightness of moorings are of importance. A ship, moored at an exposed location near a shallow fairway frequently used by large ships, must be adequately moored and have a sharp lookout. It is of great importance to establish the number and application of the moorings and the condition of the lines, if possible. The tide and/or the lowering/raising of the hull during loading/discharging operations might have made the moorings slack enough for the ship to gain momentum. The claimants should be asked to produce evidence that any slack was taken up mechanically or by regular attendance by the ship’s crew or linesmen.

7.1.4.4.5 What to do when interaction has caused damage

The first report of wash damage is often received while the ship remains in port. Upon receipt of such an indication, the Master should contact the nearest Club correspondent in order to have the evidence secured in a proper way for the defence in case a claim is filed. The correspondent will arrange for the damage to be surveyed in order to establish the nature and extent of the loss.

7.1.4.4.6 No cover for damage to own property

The cover under this section is in respect of the liability of the passing ship for damage caused to third parties. No compensation is allowed under this section, or anywhere else under these Rules, for damage caused to the entered ship, her moorings, gangways or other belongings, by wash from another ship. See the comments under 7.1.15.

7.1.5 Propeller water

A further liability related to that of interaction is when damage is caused by the water moved by the propeller of the entered ship. As there is no direct contact, liability is commonly excluded by the Hull insurance and, instead, covered under this section. Such damage can occur when the propeller is running on a ship moored at a pier or in the course of mooring or unmooring operations. The damage can be extensive. Large parts of a pier may become undermined and slide into the water along with warehouses and cranes. The propeller water may cause barges to sink or capsize, or cause damage to other ships at the quay. It is difficult to disprove an allegation of negligence in a situation like that.

7.1.6 Use of anchor

There are a number of liability situations where a contact has occurred which, in the sense of the Hull conditions, is usually not of a nature to allow compensation under the Hull policy.

Although an anchor is an integral part of the ship, liability resulting from the use of anchors is most often excluded from Hull cover unless the anchor is dropped in emergency situations in order to avert a peril insured under the Hull cover or in a General Average situation. In such cases, the damage caused by the anchor manoeuvre may be allowed as an intentional sacrifice. If a damage not covered under the Hull policy is avoided, the consequences of the use of anchors will still come under the P&I policy. See the comments under 7.3.2.

For the purposes of P&I Insurance, liability should relate to the use of the anchor. The anchor is not in use when it is in its fixed position in the hawse pipe. If it is lowered and hanging free in preparation for or after anchoring, it is considered to be in use. P&I exposure starts when the anchor leaves its position in the hawse pipe and ends at the point when the anchor is completely in its traditional resting position.

7.1.7 Use of lines and ropes

Liability for damage caused by use of mooring lines and tow ropes is commonly excluded from the Hull cover and falls within the category of cover under this clause. Mooring lines often cause damage to bollards but may also entangle cranes or other installations ashore. Liability for use of tow ropes is generally related to the conditions under which the towage is performed. That liability is dealt with in the comments to Section 8 of this Rule.

7.1.8 Use of loading/discharging devices

The Hull conditions exclude liability for the use of loading and discharging devices. “Use” means that the devices are in any stage of operation, or in preparation for or completion of such operation. It does not matter whether the damage was caused by the ship or movement of the device. Only allision/collision damage caused by ship’s movement when the device is completely in its resting position is covered under the Hull policy.

A ship’s ramp used for cargo operations is considered a loading/discharging device. When used for this purpose, any liability arising from contact of the ramp with shore installations and/or FFO in general will fall under this section.

7.1.9 Use of gangway

Damage caused to third parties by the use of the ship’s gangway is excluded under the Hull policy (except when the gangway is not in use but safely stowed and the part of the vessel being in contact in an allision/collision); the liability for damage caused by movement of the gangway, for example when lowered or raised, is covered under this section whether or not the gangway belongs to the Member.

7.1.10 Discharge of water, smoke etc.

The discharge overboard of cooling water from a ship may cause damage by short circuiting electrical installations on shore or filling barges moored alongside the ship. Liability for such damage is covered under this section. Paint spray from work performed on board belongs to the same category. So does liability for a fire which starts on or initiates from the entered ship and spreads to neighbouring ships or warehouses.

Emissions of many kinds such as soot or smoke from the ship’s funnel may constitute pollution in the sense of Rule 6 Section 1. The Member’s liability, if any, is then covered under that section.

7.1.11 General unspecified third party liability

This section is intended to absorb various situations of unspecified third party liability for loss of or damage to property, such as, for example, a valuable computer brought on board by people performing repairs and/or maintenance or by a pilot damaged by crew negligence. As long as the liability is of a Common Law nature or flows from a contract approved by the Club according to Rule 10 Section 2, it is covered under this section.

7.1.12 Third Party Liability damage caused by cargo

The Hull conditions exclude liability damage to third parties caused by cargo. The most frequent example of such damage is when cargo is dropped from the sling onto trucks, railway cars or barges at the ship’s side. These are third party risks covered by this section.

During land transport to/from the carrying vessel, containers or other units of cargo may fall off trailers and cause damage to property or injury to persons. Those who suffer damage may choose to file their claims against the sea carrier. P&I Insurance is intended to cover legal third party liability related to ocean carriage; liabilities arising during other modes of transportation are not covered by P&I.

If the accident is reasonably related to loading, shifting, discharging or other similar cargo operations on the quay or in the terminal area, liability may be sufficiently related to ocean carriage to be covered under P&I.

7.1.13 Loss of or damage to bunkers

7.1.13.1 Charterer’s bunkers

Bunkers on board may not necessarily belong to the Owner of the ship. In fact, they often belong to a time Charterer. If they are lost with the ship or damaged by contamination, the Charterer may have a claim against the Owner whose liability is decided by the terms of the charterparty. If there is such liability and if the charterparty was on customary or approved terms, the Owner’s liability to compensate the Charterer is covered under this section. Note: liability for bunkers belonging to a Charterer is expressly removed from the exclusion of cover for liability in respect to supplies and stores under Rule 11 Section 2 (l). The cover is provided under this section.

7.1.13.2 Member’s bunkers

Loss of or damage to the shipowner’s own bunkers is commonly covered under the ship’s Hull insurance.

7.1.14 Damage caused by ship’s vehicles

Liability for damage caused by trucks or other vehicles permanently stationed on board the entered ship for cargo handling is covered as long as the damage is caused within the intended operation of the vehicle on board or in the immediate vicinity of the entered ship. This is not a general traffic liability insurance. If the trucks are operated in a larger area or operated on public roads outside the terminal area, a separate liability cover is required.

Liability for personal injury or death caused by such a ship’s vehicle follows the same principle. Liability is covered under Rule 3 Sections 1, 5 or 7, respectively.

No cover is provided for damage to the vehicles themselves. Separate cover is required to the extent that the risk is not covered under the ship’s Hull insurance in connection with a casualty to the ship or heavy weather encountered.

7.1.15 Borrowed property

P&I Insurance is, by definition, insurance against third party liability risks. Therefore, the cover under this section is limited to liability for property which is not owned by the Member. In its second part, the section puts property borrowed, leased or bought under reservation of title in the same category as property owned by the Member himself. The only exception is in Rule 4 Section 1 dealing with the Member’s own cargoes according to which cover is provided to the same extent as if the cargo had been the property of a third party.

There is no cover for property owned by a co-assured Charterer nor is there cover for property borrowed, leased or bought under reservation of title. The same exclusions from cover apply to other parties in favour of whom the Member’s cover has been extended such as Joint Members and co-assureds under Rule 30 and affiliated companies under Rule 32 unless specifically stated or agreed.